Click on image at left for printer-friendly version…

Click on image at left for printer-friendly version…

By Peter E. Robbins, CFA

And Benjamin J. Michaud, CFA

Although consumers are undoubtedly enjoying the 30% decline in gas prices that has accompanied crude oil’s 45% collapse since June, investors in oil stocks are feeling some pain with the S&P Oil & Gas Exploration & Production ETF (XOP) down more than 40% versus a 5%+ gain for the S&P 500 over that same time. Given the volatility these stocks have displayed, many clients have asked us about the causes, our outlook, and potential portfolio implications. Before delving into these questions, our high-level conclusion is this: with crisis comes opportunity, and over the long run a depressed oil price environment will benefit the conservatively financed, cash-generating oil companies our clients typically own. While remaining cognizant of the medium-term risks associated with crisis environments, and thus exercising caution with regard to tactical portfolio management changes, we believe oil’s decline has created some interesting long term opportunities for these companies and for investors.

What is causing it?

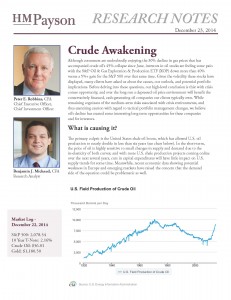

The primary culprit is the United States shale oil boom, which has allowed U.S. oil production to nearly double in less than six years (see chart below). In the short-term, the price of oil is highly sensitive to small changes in supply and demand due to the inelasticity of both curves; and with more U.S. shale production projects coming online over the next several years, cuts in capital expenditures will have little impact on U.S. supply trends for some time. Meanwhile, recent economic data showing potential weakness in Europe and emerging markets have raised the concern that the demand side of the equation could be problematic as well.

Exacerbating the U.S.-led supply/demand imbalance is OPEC’s recent step-back from its traditional role as market stabilizer, as demonstrated by Saudi Arabia’s announcement that it did not intend to cut its production. From its perspective, with other OPEC members facing budgetary pressures the incentive to “cheat” on production agreements is too high to risk such a move at this time. While this stance presents a near- to medium-term risk to the price of crude, we believe it will subside over time, as the Saudis face long-term budget constraints of their own.

Lastly, because crude oil is a global market settled in US dollars, sharp movements in the USD vis-à-vis other major currencies can influence the price of oil, typically in an inverse fashion (i.e. as the USD rises, oil falls – and vice versa). Over the long-term this inverse relationship is far from perfect – but at present, as shown in the chart below, it is in full effect as economic growth and monetary policy in the U.S. (strong/tightening) continues to diverge from Europe/Japan/China (weak/loosening), driving up the USD’s relative attractiveness vis-à-vis the EUR/YEN/RMB.

What do we see going forward?

On a long-term basis – five to ten years – we believe crude oil is undervalued relative to its marginal production cost of approximately $70 to $90 per barrel. Due to the natural evolution of the oil market, where the cheapest barrels are extracted first, marginal cost tends to rise over time, which we believe bolsters the long-term case for equity investment in low-cost oil & gas operators. Also, as skeptics of overly “easy” monetary policy, we like the natural hedge oil & gas investments provide over time against a depreciating USD.

Over the medium-term – one to five years – U.S. shale production, OPEC and the USD are likely to remain headwinds to the price of oil, creating a persistently volatile operating environment for industry participants. We believe the equity market will reflect this operational volatility by rapidly adjusting market values on even the smallest incremental data point. While we remain on alert for the opportunities this volatility will inevitably create, we believe caution is warranted over the medium-term.

On a short-term basis – six to twelve months – oil and oil-related equities are likely to retrace a portion of the declines suffered over the last six months, as they are tremendously oversold at present. While we generally shy away from making near-term forecasts, and maintain a cautious medium-term stance, at a minimum we believe that now is not the time to sell oil-related equities.

What does it mean for client portfolios?

Our broad focus on companies with strong balance sheets, high margins and shareholder-friendly management teams is of particular importance in volatile industries like oil & gas (O&G). While these attributes typically limit stock price upside in a favorable operating environment, they earn their keep in a negative environment such as the one that has developed over the last six months. Our belief is that over time, well-positioned companies will generate operational outperformance and thus stock price outperformance by capitalizing on opportunities that arise from crisis-driven environments. For example, we believe some of the larger integrated companies such as Exxon Mobil will thrive in this chaotic operating environment.

Though often criticized for its conglomerate-style integrated operating model, over-capitalized balance sheet and ultra long investment horizon, we believe Exxon Mobil (NYSE: XOM) is in fantastic operational position to take advantage of the decline in oil prices. First, the integrated model generates robust cash flow throughout the operating cycle, as O&G, Refining and Chemical cycles are relatively unique. Second, XOM’s rock-solid balance sheet allows it to maintain its capital expenditure (CAPEX) program with an oil price as low as $40; and as industry-wide reductions in CAPEX budgets reduce the demand for equipment and oil field services, XOM’s return on investment will rise over time. Finally, XOM’s long-term focus affords it the ability to acquire cheap assets that may sit on its balance sheet for years not earning a dime. Despite the uncertain medium-term outlook, XOM is our top energy selection at this time.

The rapid, precipitous decline in the price of oil has surprised the vast majority of market observers and participants. Although it will be painful for certain oil companies, there will likely be significant offsetting economic benefits that may improve the outlook for other market sectors – which we will undoubtedly be discussing in future communications. In the meantime, we wish you a joyous holiday season!

Market Log, December 22, 2014:

S&P 500: 2,078.54

10 year T-Note: 2.16%

Crude Oil: $56.01

Gold: $1,180.50

This report is distributed for the information of H.M. Payson & Co.’s investment advisory and trust clients and is not intended as an investment recommendation for the general public.

Investing involves risk of loss that you should be prepared to bear. Investors can lose all or a portion of their investment portfolio. Past performance is not indicative of future results. You should not assume that the future performance of any specific investment, investment strategy, or product referenced in this note, will be profitable. In addition, there can be no assurance that any specific investment, investment strategy, or product referenced in this note will be suitable for any client. Clients should contact their portfolio manager to discuss the suitability of any specific investment, investment strategy, or product for their investment portfolios.

HM Payson employees and clients own XOM and other stocks in the Energy Sector, which may create a conflict of interest.

In the face of elevated stock market volatility, rising US-China trade tensions,…

Maine Huts & Trails provides outdoor excursions in beautiful Western Maine, boasting…