For printer-friendly version, click here.

By David R. Hines, CFA, Director of Research

By David R. Hines, CFA, Director of Research

We’ll leave the legal analysis of the recent Supreme Court rulings regarding the Affordable Healthcare Act to the pundits on the network news. Our priority is to preserve and grow our clients’ financial assets. In that vein, we continue to find attractive investment values in high quality healthcare companies. Relative to most other opportunities, we believe these investments will perform well whatever form healthcare reform ultimately takes.

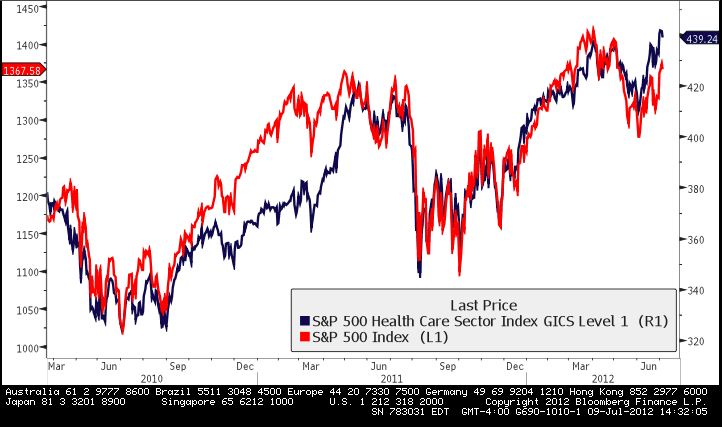

The chart below compares the S&P Healthcare Index (the dark blue line, which consists of the largest 52 US healthcare companies) and the S&P 500 (the red line, the most widely used proxy for the US stock market). The date range is from March 23, 2010 – the day President Obama signed the Affordable Healthcare Act into law – and the current date (July 5, 2012).

The chart shows – perhaps surprisingly – that healthcare companies as a group have performed almost exactly in line with the S&P 500. Moreover, on the day of the historic Supreme Court ruling supporting the individual insurance mandate, the healthcare index responded with a big yawn, and performed in line with the overall market. This suggests to us the potential negative impacts of the Affordable Healthcare Act had been priced into healthcare stocks for some time.

The chart shows – perhaps surprisingly – that healthcare companies as a group have performed almost exactly in line with the S&P 500. Moreover, on the day of the historic Supreme Court ruling supporting the individual insurance mandate, the healthcare index responded with a big yawn, and performed in line with the overall market. This suggests to us the potential negative impacts of the Affordable Healthcare Act had been priced into healthcare stocks for some time.

The table below is a sample of companies we currently find attractive. As the first two columns show, these companies boast an average free cash flow yield of 8% and an average dividend yield of 3.1%. – which compares very favorably to the 10 year treasury yield of 1.6%.

The last column tells the most interesting story from an investing standpoint but it requires an explanation. The “Price-Implied Forward Growth Rate” represents the future growth rate required to support the current price of each company based upon several simple assumptions and inputs we use to calculate this. We solve a “growth equation” for the future growth rate implied from today’s stock price[1]. This contrasts with the conventional way of applying this equation in which an analyst uses a projected growth rate to solve for a target price (a method commonly used by Wall Street analysts).

Even in an environment of more regulation and less price inflation, healthcare companies will probably experience some growth from new products, aging populations in developed countries, global population growth, and increased exports to emerging markets. Furthermore, the companies mentioned have the cash flows and financial flexibility to enhance shareholder value with increased dividends and share repurchases.

In conclusion, as is so often the case in investing, market uncertainty can present opportunities to invest at lower prices. The ongoing healthcare reform debate is just the latest example. The shares of many quality healthcare companies offer generous yields and the potential for price appreciation as the uncertainty is eventually replaced by actual results. Therefore, we maintain a generous representation of healthcare stocks in our clients’ portfolios.

[1] This calculation is based upon an equation, widely used in finance, known as the “Discounted Cash Flow Model.“

Market Log- July 9, 2012

S&P 500: 1352.46

10 year T-Note: 1.513%

Crude Oil: $85.64

Gold: $1587.30

This is printed for the information of

H.M. Payson & Co.’s investment advisory

and trust clients and is not intended as

an investment recommendation for the

general public.

If you have questions or comments regarding

this or any other Research Note, please email

the H.M. Payson & Co. Research Department

at hmpresearch@hmpayson.com.

One Portland Square, 5th Floor

P.O. Box 31

Portland, ME 04112

207 772 3761 www.hmpayson.com

In the face of elevated stock market volatility, rising US-China trade tensions,…

Maine Huts & Trails provides outdoor excursions in beautiful Western Maine, boasting…