The second quarter carried forward many of the same investment themes from the first quarter. Perhaps the most notable is the continued low volatility of the equity markets as nothing seems to rattle investors. The equity indices continued their methodical ascents to higher and higher levels with little excitement along the way. The VIX (Volatility Index) remained virtually dormant while equity markets were given plenty of excuses to panic during multiple terrorist attacks, geopolitical tensions, and, of course, the continued political uncertainty both abroad and here in the U.S. The markets seem to exhibit both a level of complacency and an undercurrent of caution as many investors expect, if not hope, for a meaningful pullback. Many would argue this level of pessimism is a required ingredient for a bull market to continue.

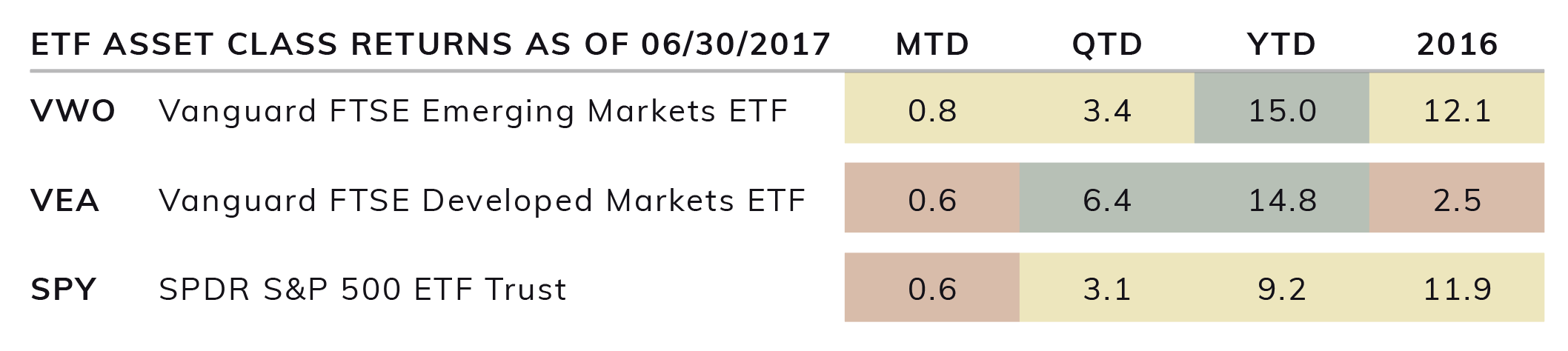

U.S. equities remain generally expensive overall with some sectors, such as utilities, industrials, and consumer staples, being the most extreme examples. While the S&P 500 was up 3.1% for the quarter and 9.2% for the year, this common benchmark for U.S. equities continued to be outpaced by international developed (up 6.4% and 14.8% respectively) and emerging markets equities (up 3.4% and 15% respectively) (Table 1). Global growth and recovery continue to be supported by consistently positive data.

TABLE 1

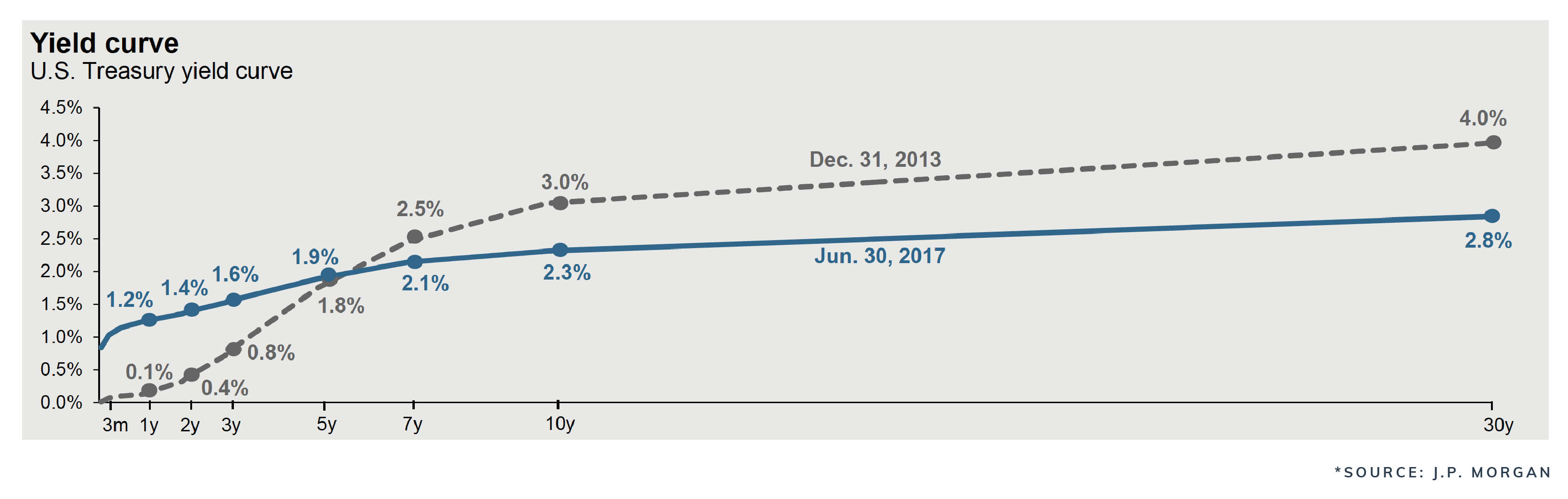

While the equity markets are indicating future economic growth and an uptick in inflation, the bond markets are telling a different story. The yield curve continued to flatten (see Graph 1) over the quarter as the Federal Reserve elected to push up the benchmark rate with its fourth hike since December 2015. The federal funds rate is now over 1% for the first time in eight years. Simultaneously, the long end of the curve has declined as the 30 year treasury recently dropped below 2.8%, primarily due to lower inflation expectations.

GRAPH 1

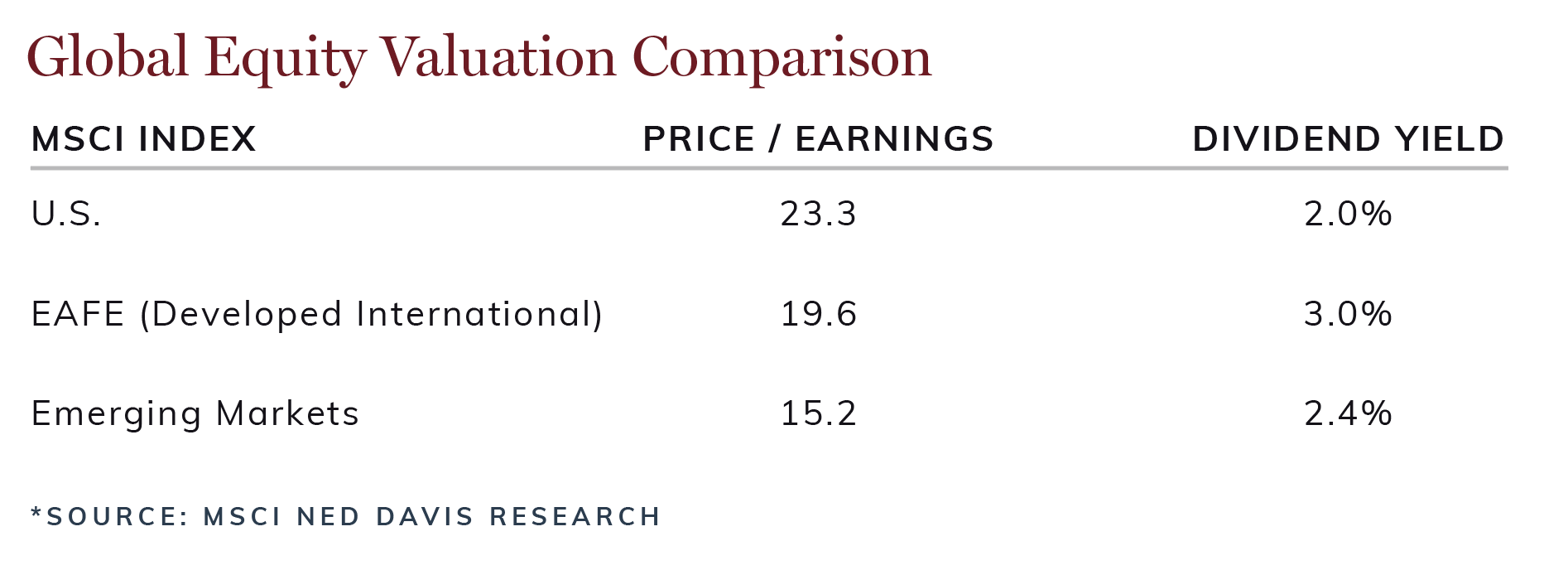

Diversification continues to play a crucial role, not only in reducing the overall risk of a portfolio, but also in adding to overall returns. We have recommended our clients allocate more to both international developed and emerging markets for some time now, primarily due to their more attractive valuations and dividend yields (see Table 2) versus U.S. equities. This rotation in asset class performance has also been on display on a more granular level across the U.S. equity sectors. The worst performing sector last year, health care, is the top performer so far this year, while the opposite is true for energy. Technology remains our largest sector weighting across our model portfolios which has helped our relative performance.

TABLE 2

One of the biggest challenges in this market environment is allocating cash. We recommend staying disciplined and resisting the allure of high dividend yields, specifically in those sectors which tend to be the most interest rate sensitive like utilities, telecoms, and consumer staples. While these sectors have performed well recently, they represent the greatest risk from a valuation standpoint in our opinion. Our research department continues to focus on identifying high-quality companies with sustainable dividend payout ratios which can grow over time. This type of careful security analysis, we believe, is critical in today’s market environment.

In client portfolios, as the dollar has proceeded to weaken versus foreign currencies as global growth accelerates, we continue to add to international and emerging markets as their valuations and dividend yields are more appealing than U.S. equities. While bonds play an important role in many client portfolios, we want to ensure this allocation is not at risk of a meaningful decline in value. The bond allocation is intended to serve as an anchor through volatile periods, as well as to provide for known future expenses, so it is critical we do not put principal at risk in exchange for more enticing yields. We recommend forgoing any incremental yield enhancement potential from going farther out on the yield curve while instead preserving capital by using short-term bonds.

In the face of elevated stock market volatility, rising US-China trade tensions,…

Maine Huts & Trails provides outdoor excursions in beautiful Western Maine, boasting…