For a printer-friendly version, click here.

As advisors, we place a high level of importance on financial planning which encompasses many aspects of life, including budgeting, retirement planning, education planning, risk management and estate planning. In December 2014, we published a paper titled “Financial Foundations for the Next Generation” as the first note in the series. The second part of that series focuses on planning for 30 – 40 year old individuals who are in the early to mid-stages of their careers. Given the increasing complexity of planning for this age group, we are breaking down the series into parts with this section focusing on understanding personal financial statements and budgeting. The next note will focus on savings & investing, and the final one on risk management & estate planning.

Creating a Plan

Where do you see yourself in 20 years? As you head into your 30s and 40s, life becomes complicated. When you are establishing your career, starting a family, managing various debts, or buying a home, it becomes important to find time to enjoy life. Planning for future aspirations is essential, but simplicity is key.

First, prioritizing goals is a practical starting point to force us to rank what is most important. What goals are you willing to compromise, if necessary, to achieve higher goals? There is no one correct order of desires. While one individual may want to own a home as soon as practical, another may want to start a family and ensure education is well funded. By understanding the economics of choices you make, you can ensure your decisions are consistent with your rank order of goals. For example, if you are planning to buy a house in the near future, but then instead buy an expensive car that consumes large amounts of disposable income, you are showing a clear inconsistency between goals and actions.

Before creating a plan, one must know where they are starting. To determine the strengths and weaknesses of your financial position, create your personal financial statements (a balance sheet and a cash flow statement).

Understanding Assets & Liabilities – The Balance Sheet

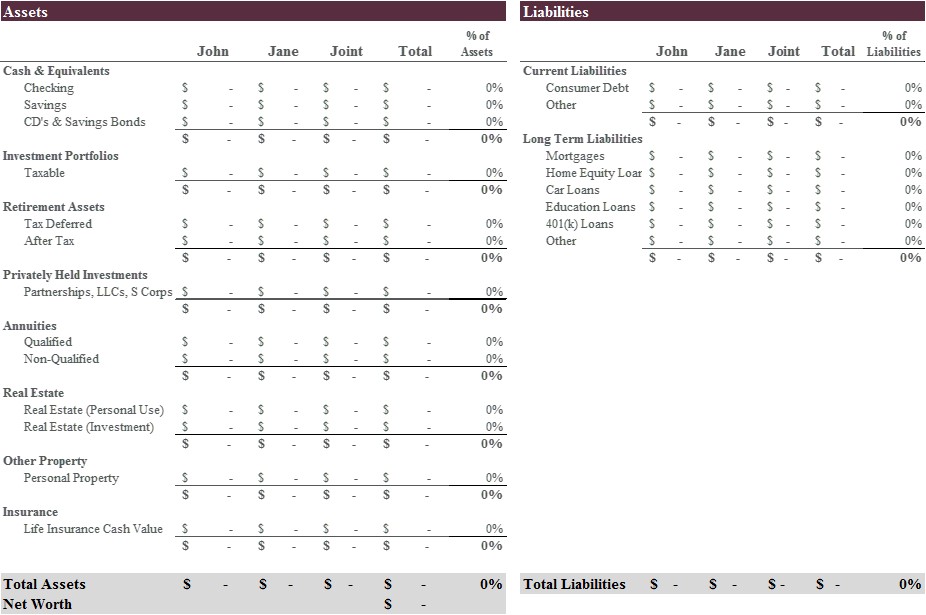

A balance sheet identifies your assets (what you own) and liabilities (what you owe). Asset types include cash and cash equivalents, investment portfolios, retirement accounts, real estate, and business interests. Assets are listed from most liquid (easiest to convert to cash) to least liquid whereas liabilities are listed from those requiring earliest repayment to those due later.

Each asset category has a distinct combination of characteristics including purpose, liquidity, tax profile, cash flow, and time horizon. Understanding these characteristics allows one to better evaluate the risk and return possibilities for the assets, both individually and in total. For example, a checking account (i.e. cash) is used to pay current bills or cover unexpected expenses, costs very little to maintain, and is quite liquid, but offers no growth nor much income. Conversely, real estate creates the prospect for long-term growth but often requires taking on debt, can be costly to maintain (property taxes, maintenance, etc.), and is illiquid.

Liabilities, or debts, are broken into two primary categories: current (due in 12 months or less) and long-term. Credit card debt is an example of a current liability while mortgages, student loans, and car loans are examples of long-term liabilities. Accumulating debt for the purpose of maintaining a lifestyle or acquiring status symbols can lead to financial stress. Debt used to finance productive, long-term endeavors (real estate, education) can be instrumental in building long-term wealth.

After building the balance sheet, determine the strengths and weaknesses of your financial position by asking:

1. How many days or months of expenses do you have in cash?

a. A reasonable target is 3 to 6 months

2. How many of your assets are cash-producing (savings, investments) and cash-consuming (personal real estate)?

a. What is the proportion between the two?

b. Can your cash-consuming assets be reasonably maintained by your cash flow?

c. Over time, you should seek to have more cash-producing assets than cash-consuming assets.

3. How many of your assets are illiquid and are they the majority?

a. What is the probability of needing to sell these assets quickly for a fair price and are you able to assume this risk?

4. How much total debt do you have?

a. Is most of it productive debt or debt accumulated to finance consumption?

b. Is the overall debt level increasing or decreasing?

c. What is the cost of financing different debts?

Next, consider your desired financial position in the years ahead and how you will need to manage your balance sheet to get there (e.g. build up liquidity reserve, increase retirement savings, pay down consumer debt more quickly, etc.).

Net worth is simply your assets minus your liabilities. Growing your net worth not only requires diligent saving and investing to build assets over the long term, but also requires managing and paying down debt effectively.

Cash Flow Statement – The Ins and Outs

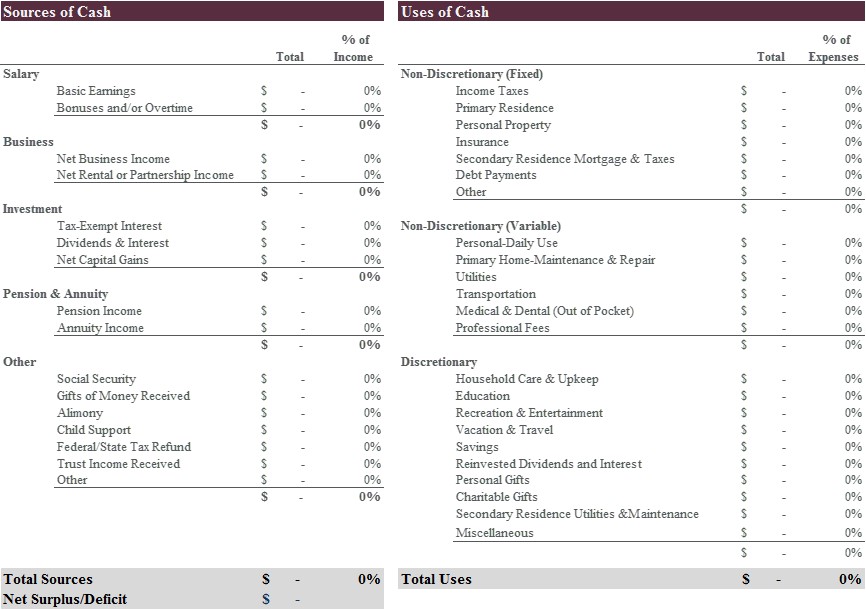

Developing a cash flow statement (and budget) is essential to creating a financial plan and will allow for a better understanding of the sources and uses of your cash. Proper cash flow management is critical to save effectively, manage debt obligations, and ultimately increase your net worth.

For most adults beginning their careers, earned income is the primary source of cash inflow. However, many may generate cash from other sources such as trust income, rental property, family gifts, etc. Living below your means is key to getting ahead financially over time. To get to this point, an analysis of the uses of cash is paramount.

A cash flow statement breaks down cash uses into three categories:

1. Fixed, non-discretionary expenses

2. Variable, non-discretionary expenses

3. Discretionary expenditures (fun money)

Savings is obviously a voluntary expenditure, but, with good financial habits, it becomes compulsory and is budgeted accordingly.

Once created, some analysis of the cash flow statement is in order. Questions to ask to gain a better understanding include:

1. Is there a surplus? If so, how much, both in dollars and as a percentage of cash inflow?

2. How much of the total is spent on fixed expenses?

a. Preferably 50% or less

b. Housing related expenses should be 30% or less

3. How much is spent on maintaining current lifestyle or fun money?

a. 30% or less is preferable

4. How much is allocated to savings?

a. Try to save 10% or more of income just for retirement

If too much is consumed and not enough saved, developing a budget becomes a necessary exercise. As you think about budgeting, where in your cash flow statement are you willing to make adjustments to ensure spending lines up with your goals and priorities? If building your net worth is a high priority, then dedicating cash flow to debt payments and savings must also be a priority.

Integrating the Two

Now, having reviewed each individually, you can examine how the balance sheet and cash flow statement need to work together. Some items to consider include:

1. How much cash is being used to support your assets (e.g. mortgage payment, property taxes, utilities)? Does this prevent building an emergency reserve or delay saving for retirement?

2. Where is surplus cash going? Is it adding to savings, paying down debt, or building retirement accounts?

3. Are the discretionary expenses so high that debt (credit card or home equity line of credit) is increasing in order to finance lifestyle?

4. Are family gifts received invested or spent?

5. Is portfolio income reinvested to build up the portfolio or used to pay bills?

Budgeting – Where to begin?

Budgeting is a means to develop strong saving and spending habits. Poor spending habits are the single greatest financial risk people face.

Begin by dividing your cash flows into three categories: essentials (aim for 50% or less), financial priorities (20%), and lifestyle (30%). Essentials include your basic needs like food and housing. Financial priorities include additional payments towards debt or saving for college and retirement while lifestyle includes all of your discretionary spending like entertainment and travel. Using this simple 50/20/30 approach will keep your spending on track. (Click here to see a budget worksheet).

Here are some simple guidelines to follow:

1. Pay at least the minimum amount due on credit cards every month.

2. Build an emergency reserve. Try to save at least $2,000 and continue building until reserves equal 3-6 months of expenses.

3. Contribute to an employer sponsored retirement plan at least up to the employer match (typically between 3% and 5% of salary). Implement an annual increase until you have reached 15% or the maximum allowable ($18,000 for 2017).

4. Start paying down debt more aggressively. Focus on the smallest debt first to pay it off quickly. Once paid, take advantage of your progress, and move that extra cash flow to chip away at the highest cost debt (usually credit cards).

5. If you have children, establish an education savings account as soon as possible and make regular contributions, even if modest. A 529 Plan, an UTMA, or a taxable account are all potential options, each having different tax and flexibility profiles.

6. Establish a non-retirement investment account at a reputable mutual fund company or advisory firm.

Conclusion

Financial planning is a marathon, not a sprint. If your finances are unsatisfactory today, do not panic. Start by tackling any pressing financial situations, such as late debt payments, then focus on your top priorities. Remember, time is a valuable asset for young adults, but it will lose its value if not used to your advantage. Take the first step by making beneficial decisions for your financial future.